Calculate paycheck based on salary

Paid a flat rate. How to calculate your paycheck.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

Note that if you have any after-tax paycheck withholding health or dental insurance premiums etc you will need to add them to the Total Withholding before calculating your net pay.

. In leap years the calculation of your bi-weekly gross is based on 366 days instead of regular 365 days. Free salary hourly and more paycheck calculators. Your bi-weekly gross changes slightly in the first pay period of a leap year and in the first pay period after the end of a leap year due to the one day difference.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour. The salary calculator estimates your net monthly salary based on financial personal and employment information you provide.

Gross Salary 432000 43200 86400 10800 10800 10800. As of this writing the 12-month rate of inflation is 2. The total amount youre paid before your employer takes out deductions is your gross income.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. The following are the steps to calculate a wage increase based on inflation. The results of the calculation are based on the details you have entered.

This includes just two items. Know How to calculate taxable income on the salary in India - Check all about Perquisites Deductions All types of Taxes Taxable Income Tax Calculation. A salaried employee is paid an annual salary.

To answer many of these questions you will need to know how to calculate wages from rates to salaries for various different time frames. Analyze your skills and expertise. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

The amount of Federal income taxes withheld from your paycheck is based on three factors. Every company has its own employment costs calculator to calculate how much spend on their salary pay based on job title. If your pay fluctuates based off tips varying hours andor commissions you can.

This is the number of pay periods in the average month given that a 365-day year has 5214 weeks. Switch to hourly calculator. Maybe you have an employee who took on new responsibilities or added a new skill or title.

Again you can determine how much the employees paycheck increases by dividing their annual salary by 52 weekly 26 biweekly 24 semi. Above wages are per. Your annual salary remains the same whether it is a leap year or not.

That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. When the benefits calculator uses to evaluate job salary there may get pay different based on the company industry divided. Gross Salary is calculated as.

If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Multiply your take-home pay for one paycheck by the number of paychecks in a year.

Fill out a Form W4 federal withholding form with a step-by-step wizard. How to calculate salary increase. If you work in human resources you will need to be ready to answer a variety of questions regarding paychecks.

The annual salary in our case is 50000 and we work 40 hours per week. Get the 12-month rate of inflation from the Consumer Price Index CPI. Calculate the Gross Salary and Net Salary of the following salary components.

Multiply this by 217 to find your gross monthly income if you are paid every two weeks. Follow the steps below to negotiate a salary based on the salary range you provide. Their name and the state where they live.

To calculate net pay subtract the total withholding for the pay period from the gross wages for the period. How Your Paycheck Works. During the interview and job offer process employers may present you with a salary that you may want to adjust according to your financial and personal needs.

If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with the equivalent monthly wages. You might also offer a salary increase based on merit. This guide will help you convert bi-weekly pay to an annual salary.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. If you are paid 60000 a year then divide that by 12. ReTH65gcmBgCJ7k This Page is BLOCKED as it is using Iframes.

Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885. Heres a step-by-step guide to walk you through the tool. Hourly Wages to Convert Amount.

How to negotiate a salary based on salary range. This estimation is only for informative purposes and under no circumstances may it be considered binding. If you pay salaried employees twice a month there are 24 pay periods in the year and the gross pay for one pay period is 1250 30000 divided.

For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. Lets say the annual salary is 30000. Then divide this number by 12 to get your monthly income.

How to Calculate Salary Increase Based on Inflation. Fill in the employees details. Lets say your employer pays you a salary of 4000 per monthInstead of giving you that 4000 each month your employer must deduct your FICA taxes for Social Security and Medicare as well as any benefits youve arranged to take such as optional insurance eg.

For this purpose lets assume some numbers. When it comes to a budget take-home income is the only income that matters. Weekly paycheck to hourly rate.

Your salary which determines your tax bracket The number of exemptions you claimed on your W-4. Calculate the gross wages based on a net pay amount. How to Calculate Monthly Income.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Salary Paycheck Calculator Payroll Calculator Payroll Paycheck Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Payroll Calculator Template Free Payroll Template Payroll Business Template

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Love Calculator 401k Calculator

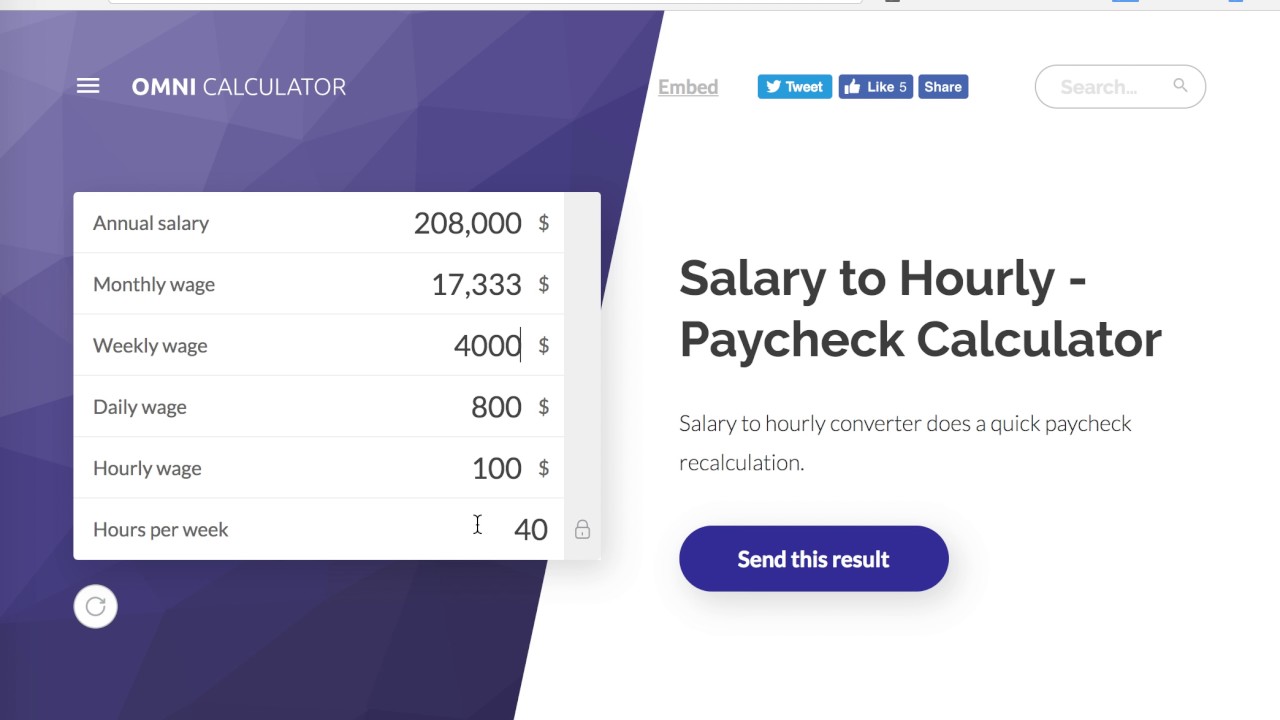

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Love Calculator 401k Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Salary To Hourly Calculator

Quickbooks Paycheck Calculator Intuit Paycheck Calculator Quickbooks Paycheck Payroll Taxes

Pin On Payroll

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template